Vishal Fabrics’ H1FY23 PAT stood at INR 30 crore

India 11th November, 2022:- Vishal Fabrics Limited (BSE: 538598) (NSE: VISHAL)

announced its un-audited standalone financials for the second quarter and half

year ended 30th September 2022.

Commenting on the performance, Mr. Brijmohan Chiripal,

Managing Director, said, “During the quarter, the

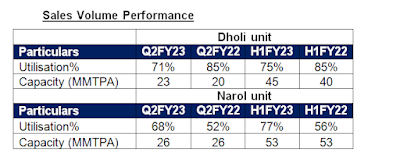

overall demand scenario remained muted owing to ongoing economic challenges,

volatile cotton prices and global inflationary pressures. As a result, our

capacity utilization levels were on the lower side, impacting our margins

negatively. We are ready to sail through these challenging times with a

comfortable level of debt-equity ratio at 0.98x. Although the short-term

headwinds may continue, we remain confident about the long-term growth

prospects for the Indian textile sector as well as our capacity to raise

utilization levels and get back the revenues at normalcy.”

Financial & Business Highlights:

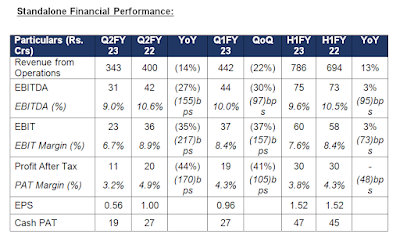

Revenue

The Company recorded Revenue of Rs.343 Crs

during Q2FY23, as against Rs. 400 Crs in Q2FY22

Revenue for H1FY23 stood at Rs.786 Crs, as

against Rs.694 Crs in H1FY22

The decline in revenues is due to muted demand scenario experienced in the overall textile industry this quarter.

EBITDA

EBIDTA for Q2FY23 stood at Rs. 31 Crs as compared to Rs.42 Crs for Q2FY22, a de-growth of 27%.

EBIDTA margins for Q2FY23 stood at 9.0% as

compared to 10.6% in Q2FY22, a de-growth of 155bps.

Volatile raw material prices put pressure on the EBITDA margin

EBIDTA for H1FY23 stood at Rs. 75 Crs as compared to Rs.73 Crs for H1FY22, a growth of 3%.

EBIDTA margins for H1FY23 stood at 9.6% as compared to 10.5% in H1FY22, a de-growth of 95bps.

PAT

Net profit after tax for Q2FY23 stood at Rs.11 Crs

as compared to Rs.20 Crs for Q2FY22

Net profit after tax for H1FY23 stood at Rs.30 Crs as compared to Rs.30 Crs for H1FY22

EPS for Q2FY23 stood at Rs. 0.56

EPS for H1FY23 stood at Rs. 1.52

Debt Reduction

We target to reduce debt by Rs. 35-40 Crs in FY23 out of which Rs.22 Crs has already been paid by Sept 2022.

About Vishal Fabrics Limited:

Vishal Fabrics Limited (VFL) is a denim manufacturing and fabric processing unit incorporated in 1985. A part of the renowned Chiripal Group, the Company leverages over 3 decades of experience to provide unmatched products to a diverse clientele. The Company constantly strives to improve its manufacturing facilities and aims to develop India’s leading dyeing, printing, and processing units. Its state-of-the-art manufacturing facilities are equipped with the latest technology and deliver innovative products that adhere to international quality standards. Over the years, the company has managed to emerge as a pioneer in the textile industry, setting new standards of excellence.

Safe harbor statement: Statements in this document relating to future status, events, or circumstances, including but not limited to statements about plans and objectives, the progress and results of research and development, potential project characteristics, project potential, and target dates for project-related issues are forward-looking statements based on estimates and the anticipated effects of future events on current and developing circumstances. Such statements are subject to numerous risks and uncertainties and are not necessarily predictive of future results. Actual results may differ materially from those anticipated in the forward-looking statements. The company assumes no obligation to update forward-looking statements to reflect actual results changed assumptions or other factors.

0 Comments